The Seattle City Council unanimously passed a budget action Monday for new city rules on bike share companies that will expand the number of bikes in operation, increase the fees for bike share operators and put in place new regulations around the parking of the shared bikes.

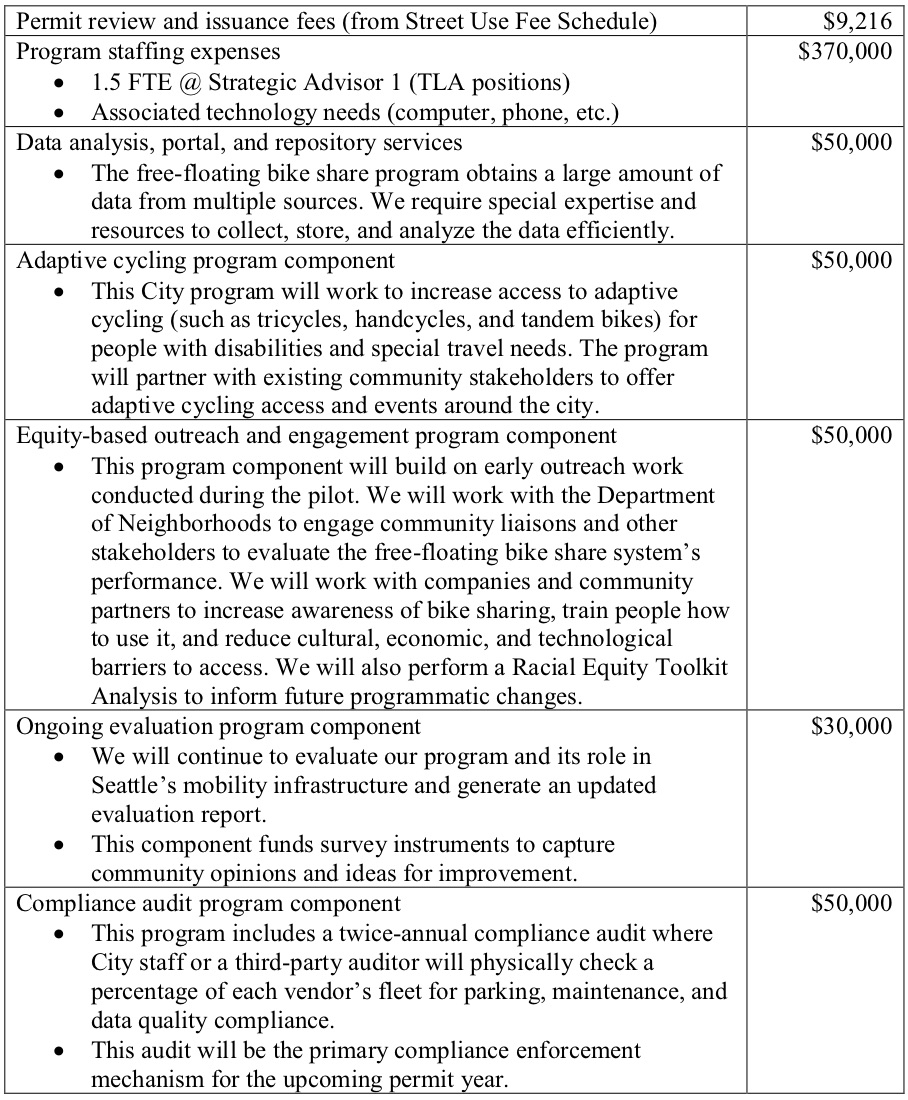

The Council action also outlines $1 million in spending for administration, adaptive bicycle access, equity programs, a new parking compliance effort and a major expansion of bike parking. These investments will be covered by a major hike in fees for the bike share operators.

We previously expressed concerns that the hike in fees might be too steep, especially for the lowest-priced options such as the pedal bikes that cost just $1 for a ride. Indeed, the lowest-cost operator has announced they are leaving Seattle due to the fee hike. ofo, which offers rides at $1 for an hour (vs $1 for a half hour by the other operators), confirmed to Seattle Bike Blog that they will be leaving Seattle.

“We appreciate the efforts of City Council and SDOT in crafting new requirements for dockless bikeshare in Seattle,” said Seattle General Manager Lina Feng in an emailed statement. “The exorbitant fees that accompany these new regulations—the highest in the country—make it impossible for ofo to operate and effectively serve our riders, and as a result, we will not be seeking a permit to continue operating in Seattle. We’re incredibly disappointed to be leaving the first U.S. city to welcome ofo and thank the City for its partnership and support this last year.”

Lime, on the other hand, says they will apply for the new permit as soon as it is available, and plans to expand its pedal and e-assist bikes.

“We’ll absolutely be applying for bikeshare permits when they become available next month, and plan to continue to serve this city and beyond with viable, accessible and affordable mobility options,” said Gabriel Scheer, Director of Strategic Development at Lime, in an emailed statement.

We have reached out to Spin for comment and will update when I hear back.

The Council action only pertained to the new fees and budget additions, and the specifics of the permit would still fall within SDOT’s purview. SDOT has stated its intent to increase the total number of bikes to 20,000 across four companies. This opens the door to at least two new companies. Uber-owned Jump has already made it clear that they want to operate their e-assist bikes in Seattle.

ofo has spoken against the bike share fee hike throughout the process, but their decision to leave Seattle comes as the Beijing-based global bike share giant is dramatically scaling back their services across the U.S.

The new bike share permit has lots of great language geared toward equitable access to the bikes, but the number of bikes and price to ride are ultimately the best ways to make them accessible to more people. Losing ofo’s fleet of $1 bikes would be a huge hit to affordable mobility in Seattle if the void they leave is not filled by another operator.

For a city that talks so much about combatting climate change, it just seems so backwards to charge companies providing low-cost bike rides so much money. Their success would also be Seattle’s success. We need more people to bike, a goal these companies are making possible. We should be making it as easy as possible for them to operate successfully here. Just because the investment capital is flowing into bike share lately doesn’t mean they will be flush with cash forever. We need affordable bike share here long-term.

Here’s an outline of the programs funded by the $1 million in fees:

Comments

22 responses to “Council approves bike share expansion + ofo cites fee hike in decision to leave Seattle”

This is a totally ridiculous move by our utterly inept Seattle Council. It doesn’t take an economics degree to figure out that the bike share companies must be losing money hand over fist. So instead of recognizing that the city is getting an incredible deal and doing all it can to support the companies providing this corporate subsidy to transportation, the city decides to gouge the companies for the inflated costs of what it actually cost for the city to administer the system. In all likelihood, in a few years time bike rental in Seattle will have morphed to a high-priced monopoly of e-bikes, electric scooters and rentals aimed at tourists.

The city’s decision is largely in response to Pronto. After the city pumped $5 million into a system that was about to be ripped up, any taxpayer subsidy for bikeshare has become politically toxic, so the city council must bend over backwards to ensure that not one dollar of city funds is being spent on this. This is the framework for the decision. If the system becomes popular enough, attitudes may change in the future, but, for now, it is what it is.

We will see what happens over the next few years, and I agree, higher fees per vehicle will result in low-priced services getting replaced with higher-priced services. That said, while Lime-E is too expensive to use for everyday commutes, it is still about 70% cheaper than Lyft and Uber, and reasonably priced enough for occasional trips. It is possible that part of the reason why Lime-E costs so much could be monopoly pricing because there are no other E-bike operators out there. Perhaps Jump could create competition, resulting in lower prices.

We could just change our model for bike corrals, which would actually be useful for some users (like me!) who have cargo bikes that can be locked just like bike share bikes. Make the bike corrals longer, with more empty space on the end, and mark them with paint (“free floating parking” or something; useful for bike share, bakfiets, scooters, motorcycles, etc). Then we’re not subsidizing bike share – we’re just providing bike parking that’s in high demand by bike riders on various types of bikes.

There is a difference, though. Previously, the need for on-street bike parking was largely confined to commercial areas. Residents very seldomly park their bikes on the street next to their homes, since it is much more secure to park them in a garage, storage room, etc. – somewhere on private property where thieves and vandals can’t easily access. Only when people arrive at their homes on a bikeshare bike, do they suddenly need a place to park on the street, and when proper places to park do not exist, that’s when you start to see people blocking sidewalks, parking on grass, leaning bikes against buildings, etc.

It is residential areas – particularly those with lots of multi-family housing (e.g. the density to create lots of demand for bikeshare) – where the new bike corrals are most needed.

Asdf, while it may seem like Pronto is the source of this attitude, you find a similar one in other major American cities. Honestly, it’s the atittude that if something might someday turn a profit, it ought to be taxed (though these businesses already pay taxes on incomes and such).

…so the city council must bend over backwards to ensure that not one dollar of city funds is being spent on this.

These are all for profit companies, with millions of investment backing to slurp up customers data and sell on the open market. It costs the City a non-zero amount of money for them to exist. They do not deserve a single penny of public money.

I believe they are leaving the City due to the increase in fees as much as I believe that Trident Seafoods is leaving Ballard because of the homeless. It’s all smoke and mirrors and an easy excuse to point to.

I do believe they were losing money, but it was due to (1) being third to the table, (2) being a China-based company that people were nervous to give their information to (Spin and Lime are American companies) and (3) allegedly treated their workers poorly and abused homeless employment companies…in a City and region that has a history of valuing workers’ rights. Plus, they were the worst at illegally leaving bikes in the middle of sidewalks, multi-use trails and even accessible ramps during their redistribution efforts.

Good riddance to a poorly run, potentially toxic company. Let someone more worthy fill the gap.

It was pointed out back when the city was exploring dockless bikeshare post Pronto that there inevitably will be costs associated with the new dockless approach; namely signage, parking enforcement, oversight, not to mention the time and effort involved in understanding this new system and developing an entirely new regulatory infrastructure for it to actually work for all users of the city.

There is a cost to manage and maintain the “commons” of any city and why should Seattle and the taxpayers eat that cost when it comes to Bikeshare, or for that matter all of the gig economy mobility services (Uber, lyft, bikes, scooters, etcetera)? Now what exactly this cost is, is worth discussion as pointed out in the article but relying on any of these mobility providers to self police or the “free market” to correct is an exercise in delusion.

And yet we support freight, construction etc. for for-profit companies.

So, how many bikes does ofo have out currently?

Are they going to ship them out of the USA, sell them to another bikeshare company, donate them to charities, issue $1,000 codes in free rides and let users just have fun, or wait for SDOT to collect them into giant disposal piles like those stories about ofo bikes in China from earlier in the year?

Nothing the city can do, but it seems pretty non-green to do something that takes the yellow bikes off the roads.

[…] the vote, one Seattle provider already on the way to shutting down its operations in the city said the fee would be the final straw while another said it was eager to be part of the expansion. So, goodbye, yellow bikes and it looks like the green bikes are here to […]

ChefJoe, in other cities where they pulled out, ofo removed the locks and donated the bikes to a local organization.

These fees are crazy. Ofo is leaving the US because they can’t make money. Not so much because of intense competition (they were the sole provider in most cities), but because it’s a new concept and making $200 a day doesn’t support a corporation.

Adding new costs on top of it is a quick way to nip most of the industry in the bud, leaving only tourism focused $5 for 30 minute options (ie, the bike share system in San Diego and Miami Beach which are 100% supported by user fees)

“Ofo is leaving the US because they can’t make money.”

Granted, I haven’t studied all the numbers, but I think there’s a difference between “they can’t make money” and “they can’t make the money they want”.

In Dallas they dumped them at a recycling center:

https://www.npr.org/2018/08/07/636347531/hundreds-of-bikes-dumped-at-dallas-recycling-center-as-ofo-leaves-market?utm_campaign=storyshare&utm_source=facebook.com&utm_medium=social

[…] Times, Curbed, GeekWire, Q13, Seattle Magazine, and Seattle Bike Blog all report on yesterday’s Council vote to approve expansion of the […]

I’m generally skeptical of businesses when they say taxes are prohibitive, but I think the bike share tax is quite steep. I also think SDOT’s numbers sounds more like a “wish list” and less like a “bare minimum.”

Some quick math:

5000 bikes * 1 ride/bike/day * $1/ride * 365 days/year = $1,825,000/year in revenue per company.

From that, a $250,000 fee amounts to a 13.7% tax. The big assumption is $1/ride average, but even doubling that still makes it a 6.8% tax. I would assume that over-estimating the rides/day (current usage is 0.7 rides/bike/day) balances out under-estimating the revenue per ride.

This doesn’t seem like a lot of money to fund the whole operation of maintaining bikes, rebalancing, credit card fees, software development, etc. They would already be subject to the city B&O tax (0.427%), the state B&O tax (another 0.47%), and federal taxes (who knows…). does anyone know if they have to pay the 10% sales tax out of the $1/30 min as well?

As a point of comparison, we charge a 16% gas tax, which mostly funds massive highway infrastructure projects like the tunnel boondoggle, but there is no cap on the amount of gas sold in the state, and right now there’s about $20BILLION of gas sold/year in washington, and these revenues only make up 34% of the state DOT budget. Another comparison would be cigarettes, which currently carry a ~33% tax and 20.5% on hard alcohol.

It’s also worth noting that by capping the number of bikes on a per-company basis, there is no room to grow. The only option will be to increase rides/bike/day (which seems hard to do especially before there’s decent infrastructure), or increase the $/ride, which will be a delicate balancing act between market demand and equity.

So, we have a fledgling program that promises to provide more efficient transportation options that generates a net benefit to society in terms of health and reduced congestion while requiring almost no additional infrastructure ($400k of bike corrals could easily be scraped out of existing bike parking allotments, and as Andres suggested they could do paint-only corrals for a fraction of the cost). Instead of subsidizing this with general fund money like we do for car infrastructure and public transit, we cut their bottom line with a tax comparable with punitive taxes on public harms and luxury goods, while at the same time putting limits on their growth.

Rachael Ludwick astutely said that this is like putting a hefty tax on a wind farm. I’d add that we’ve also put limits on the number of turbines, and (by not allowing scooters or faster Jump bikes), we’re restricting what kind of turbines can be used.

Finally, now that we’ve set a precedent for taxing private companies that are using our public infrastructure, can we start taxing Uber and Lyft?

I tend think of it more as rent, rather than a tax, since, after all, the bikes are being stored in city-owned right-of-way between uses. If each bike takes up a 2’x5′ block (10 sq. ft) then $50/bike/year = $5/sq. ft/year = $5000/1000 sq. ft./year = $416.67/1000 sq. ft. / month. Any 1000 sq. ft. retail storefront in a reasonable neighborhood would rent for far more than this.

Of course, it is quite unfair to expect bikeshare companies to pay full price for storing their inventory on city ROW, while cars get to use the streets for parking for little or nothing.

So I went into this thinking, “$250k/yr is not going to make the difference between operational profit and loss.” But…

5k bikes times 365 days/yr times, say, 3 rides-per-bike-per-day (a number sometimes cited for operational profitability) is a bit over 5 million rides per year. At $1 a ride that’s $5 million gross revenue per year. $250k is 5% of that — 5% of gross revenue could be the difference between operational profit and loss.

Obviously ofo isn’t close to 5 million rides per year, and that cuts both ways. On one hand, they probably (probably — I don’t know how many rides they actually need to break even) aren’t particularly close to being operationally profitable. On the other, the $250k fee represents a much larger portion of their revenue!

It’s tough because… that’s apparently what it costs to administer the program, and I don’t think we want to take cuts out of other cycling programs to fund it (insert stuff about whether bike availability is what’s holding back cycling in this city/region/country). I think we’d say similar for, say, app-taxis: when we have to spend a bunch of public money to build what amount to taxi stands (see 7th Ave, the airport, etc.) for companies that literally started up to dodge taxi regulations, that justifies regulation and fees.

Another way to look at this is that $250,000 / 5000 bikes is a $50 fee to place a single bike on the street. It wouldn’t surprise me that the cost of goods for a bike is less than that.

Typically things that the government wants to discourage are taxed heavily (cigarettes, alcohol, etc) while things encouraged are often subsidized. This is totally backward.

Do freight companies, delivery trucks, taxis, ubers, etc pay the full cost of the roads and other commons that they use or are they inherently subsidized by the city ? If they are (and they are) then why shouldn’t bicycle share also be subsidized ?

I also wonder how much of the deteriorating economic relationship between the US and China played into ofo’s decision.

In the long term operational profits are required, not just for growth but for survival. The companies probably need to increase rides-per-bike-per-day to be operationally profitable, regardless of fleet size.

I agree that it will be hard to increase rides-per-bike-per-day without better infrastructure. So if we want bike-share to succeed we’d better get that infrastructure done before the companies run out of venture capital, ‘eh?

I rode ofo once or twice when they started and I rode them pretty regularly when they were essentially free all winter. I have not been on one since because they don’t work for my size. I ride Lime and Lime-E pretty extensively, although once in awhile I get one of the tiny Limes and it is pretty tough sledding if there is any elevation change at all. Every Lime-E is a good size for me and adjusts well all the way to the bottom. They’re not dirt cheap, but a ride from King St. Station to my office is by far the fastest route between those two points and I don’t have to bring my bike on the train.

[…] Companies could pay up to $250,000 in fees to the city (one current provider, Ofo recently announced that it would be exiting the Seattle market due to the new fee structure). […]

[…] one month of Seattle imposing new regulations and a $50 per bike per year permit fee, Sarah Anne Lloyd reports that both Ofo and Spin are on […]